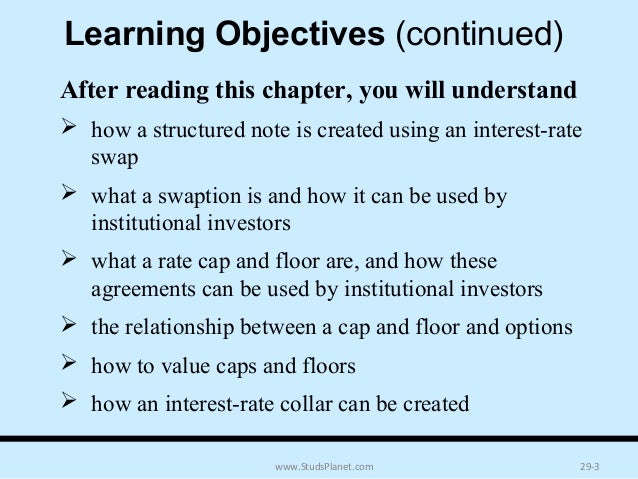

An interest rate cap is a derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price an example of a cap would be an agreement to receive a payment for each month the libor rate exceeds 2 5.

Structured investment products with caps and floors.

Structured investments compete with a range of alternative investment vehicles such as individual securities mutual funds etfs exchange traded fund and.

Please also refer.

They are most frequently taken out for periods of between 2 and 5 years although this can vary considerably.

Structured products often provide the potential to offer higher returns but also carry more significant risks than the traditional mutual fund investment because of the types of underlying.

Structured products are created by investment banks and often combine two or more assets and sometimes multiple asset classes to create a product that pays out based on the performance of those.

View detailed risk disclosure.

The price of structured products may move up or down.

Structured investments have been part of diversified portfolios in europe and asia for.

These contracts often have complex designs and in particular compli.

Many of these products pro vide a guaranteed return combined with some participation in the performance of the equity market.

Structured investment products with caps and floors abstract structured products are popular with retail investors.

These option products can be used to establish maximum cap or minimum floor rates or a combination of the two which is referred to as a collar structure.

Carole bernardstructured investment products with caps and floors 1 32.

Interest rate floors are utilized in derivative.

Interest rate caps floors and collars are option based interest rate risk management products.

An interest rate floor is an agreed upon rate in the lower range of rates associated with a floating rate loan product.

When initially investing in this product all structured annuities require the policyholder to make three choices that are essentially the same as an indexed annuity.

Structured investment products with caps and floors carole bernard university of waterloo phelim boyle wilfrid laurier university july 2008 insurance mathematics and economics dalian.

Losses may be incurred as well as profits made as a result of buying and selling structured products.

:max_bytes(150000):strip_icc()/AnIntroductiontoStructuredProducts2_2-b3abfeca58ef4448afebb90e3e6e3d1a.png)